It often happens that a new product line is launched before the old product is completely sold out. Or simply the demand for the product has decreased significantly, or maybe the company is developing a new market segment. And then the goods are sold at greatly reduced prices. But many accountants are afraid to reduce the sales price below the purchase price, since this is allegedly prohibited by law and is fraught with additional taxes. Let's see if this is actually true.

Concern 1. Selling below cost is prohibited by law.

In general, the contracting parties determine the price of the goods themselves. An exception is prices that are regulated by the state, for example in the field of electricity, gas supply, communications<1>. So for a regular contract, there is no lower price limit on the part of the Civil Code. The main thing is that this price suits both parties.

The Federal Antimonopoly Service also monitors prices to prevent abuses by “big players” in the field of pricing. However, companies that are not able to influence the price situation on the market through their actions alone or with a group of other companies have nothing to fear<2>.

Note. In 2013, the FAS prepared amendments to the Law on Trade Activities, advocating a ban on sales at a price below cost, but the project did not find support in the government, was sent for revision and has not yet even reached the State Duma.

Conclusion

If your company does not have a decisive influence on pricing in the market and does not sell goods whose prices are regulated by the government, then the lower price limit is not limited.

Concern 2: Loss from selling below cost is not taken into account for tax purposes.

Let's say right away that this is not so. The tax base for profits is calculated cumulatively for all transactions<3>. And only if a special procedure for calculating the tax base is established, income and expenses for these operations are considered separately. For example, a special procedure is provided for transactions with securities<4>. In addition, there is a direct prohibition on recognizing in expenses the price difference between the market price and the price of selling the goods to the employee. If you sold a product to an employee at a non-market price, which is even lower than the purchase price, then it is obvious that such a price difference is formed and, in fact, it represents a loss when selling below cost<5>.

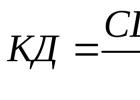

But for other sales and purchase transactions at a loss, there are no special rules. Therefore, schematically it looks like this: income from all transactions is summed up and all sales expenses recognized in the reporting period are subtracted from the resulting amount.<6>. Obviously, revenue from a loss-making transaction will be recognized in sales revenue along with revenue from other sales, and expenses on it will be recognized along with expenses on other transactions. If you do not systematically work in the red, then it is generally unrealistic to detect unprofitable trades. They will simply drown in the general mass, and they will not be visible in the income tax return<7>.

With the “profitable” simplification, selling at a loss does not in any way affect the amount of tax: how much money you received for the product is calculated from that amount<8>. If the simplification is “income-expenses”, then even in this case it is not so easy to track a loss-making transaction; income and expenses on it may generally fall into different reporting and even tax periods. After all, expenses are recognized as the goods are paid to the supplier and sold, and income is recognized upon receipt of money from the buyer<9>. When selling goods to employees, the price difference between the retail price and the sales price is also not included in expenses.

Conclusion

It is unlikely to track a losing trade if you do not systematically work in the red. It is unlikely that the tax authorities will deal with this, because the loss from sales, if the goods are sold to non-employees, is still taken into account for tax purposes.

Concern 3. If the sales price is lower than the purchase price, tax authorities assess additional taxes based on the market price

There is some truth in this judgment. It all depends on whether such a transaction is controlled. Let's say you sold apples at a price lower than the purchasing price of a third-party Russian company. Then you can safely look the inspector in the eye, since the price of the transaction between parties that are not dependent on each other is initially considered to be market price<10>. That is, tax authorities will not check your prices to see if they correspond to market prices. Simply because this type of verification is provided only for controlled transactions, and transactions between non-interdependent Russian organizations are not controlled<11>.

Note. “What about Article 40 of the Tax Code?” - you ask. Despite the fact that the notorious Art.40 of the Tax Code on market prices has not yet been repealed; its effect has been significantly narrowed: it applies only to those transactions for which income and expenses were recognized before 01/01/2012. That is, at the moment, tax officials can try to recalculate taxes based on market prices only if the “sale” took place in 2011, since 2010 and earlier periods can no longer be covered by the on-site audit scheduled in 2014 G.<12>

But if you sold a product at a non-market price and such a transaction is controlled for you, for example, you sold apples for mere pennies to your subsidiary on OSNO, the amount of income from transactions with which exceeded the uncontrollable threshold (in 2013 - 2 billion rubles, in 2014 - 1 billion rubles)<13>, then in this case you will have to<14>:

<или>during a “price” audit, prove to the tax authorities that the apples were impossibly sour and the transaction price falls well within the range of prices at which such goods are sold by non-dependent persons<16>. If the tax authorities nevertheless consider that the prices were not comparable with the market ones, then after a “price” check they will go to court to collect arrears and penalties for income tax and VAT<17>. And if the income from the transaction relates to 2014, then the tax authorities may also impose a fine in the amount of 20% of the amount of unpaid taxes<18>.

We tell the manager

If the seller independently calculates and pays taxes at the market price on income from a controlled transaction, then the buyer will not be able to recalculate the tax base downwards. After all, he will have such a right only if, after checking prices and paying the arrears by the seller, the buyer receives a notification from the tax authority to make symmetrical adjustments<20>.

But transactions of sellers under the simplified taxation system are not subject to price control, since such organizations do not pay either income tax or VAT, for which additional charges are possible during “price” checks<19>.

Conclusion

The statement that taxes will be recalculated based on market prices is only partly true. It all depends on whether the transaction is recognized as controlled. If yes, then you will have to prove to the tax authorities that the transaction price is comparable to the market price. If not, then there is no need to worry about additional charges.

Concern 4. Expenses for the purchase of goods sold at a loss are economically unjustified, and therefore cannot be taken into account when calculating income tax

Every commercial organization, by definition, strives to make a profit.<21>. However, one-time losing trades also fit into this concept, because the desire to systematically make a profit is fraught with risk and does not exclude a loss. In addition, by selling today at a low price, the company insures itself against increased losses in the future, so management assesses the profitability of the deal at the current moment.

Note. In what cases transactions between interdependent persons are not considered controlled, you can read in the article “On interdependence and controllability frankly”: Civil Code, 2013, No. 21, p. 66

The Tax Code does not give tax authorities the right to assess how effectively capital is managed, and therefore the concept of “economic feasibility of expenses” must be considered through the focus of expenses on generating income<22>. And in the example with apples, the costs of purchasing goods were economically justified, because, firstly, they were not purchased for a charity event, but were going to sell them successfully, with a profit. Another thing is that circumstances have changed somewhat and now it is much more important to release working capital frozen in an unsuccessful batch of apples. And secondly, they still received income, because there is some kind of income<23>. And no one is insured against losses<24>.

To confirm the validity of your expenses, you can do the following. First, the manager must issue an order to mark down goods. Secondly, the markdown must be justified. For example, you can attach to the order the conclusion of a merchandise expert or sales manager that the apples are from last year’s harvest, it is impossible to store them for more than 1 month in the conditions of your warehouse, and in case of loss of marketable condition, the losses from write-off will be much higher, etc. In any case, the justification must indicate for what purpose and why you decided to take a losing trade. All this will help you strengthen your position in the event of a dispute with the tax authorities.

Conclusion

Expenses will be economically justified if they were aimed at making a profit. The end result is not decisive.

Concern 5. If goods are sold at a loss, then VAT cannot be deducted on them

Tax authorities are inclined to see an unjustified tax benefit in a loss-making transaction, since the deduction for the acquisition was greater than the sale of the goods. And all because the reasonable economic goal of concluding a reduction in the amount of tax accrued in a regular transaction is not at all obvious to the tax authority. And as we remember, its absence is one of the signs of receiving an unjustified tax benefit<25>.

Therefore, just as to justify expenses, you need to stock up on arguments in your favor in advance. The same documents will do: orders from the manager, conclusions from merchandising experts, financiers, etc.

In legal disputes, the case is resolved in favor of the taxpayer if he provides the court with evidence of the existence of a reasonable economic goal that was pursued when concluding a loss-making transaction<26>. But if there was no such goal, and by all indications the organization is a participant in the tax scheme, then do not expect mercy from the tax authorities. In addition to the unobvious economic purpose, controllers will identify other signs of receiving an unjustified tax benefit, for example, the inability to fulfill the contract. For example, an organization purchased a batch of goods, but where it was stored for a whole month is unclear, since the organization neither owns nor leases warehouse premises, and although a custody agreement was concluded, it was not fulfilled<27>.

Conclusion

A tax benefit in the form of a VAT deduction for goods sold at a loss can be justified if the organization proves that when concluding a loss-making transaction it pursued a reasonable economic goal, for example, to avoid even greater losses from the complete write-off of the goods. But if the goods were sold only on paper and there were no real transactions, then the tax authorities will remove such deductions.

* * *

So, of all the concerns considered, the most realistic is the removal of expenses and deductions. To prevent this from happening, prepare justification for expenses in advance. And if, God forbid, you are a participant in a tax scheme, then fake documents alone without real transactions are unlikely to help you.

<1>clause 1 art. 424 Civil Code of the Russian Federation; clause 1 art. 4, art. 6 of the Law of August 17, 1995 N 147-FZ; subp. 4 clause 2, clause 4 art. 8 of the Law of December 28, 2009 N 381-FZ

<2>Part 1 Art. 5, part 1 art. 7, clause 1, part 1, art. 10 of the Law of July 26, 2006 N 135-FZ

<3>clause 1 art. 274 Tax Code of the Russian Federation

<4>clause 2 art. 274, art. 280 Tax Code of the Russian Federation

<5>clause 27 art. 270 Tax Code of the Russian Federation

<6>clause 1 art. 247, sub. 3 clause 1, clause 3 art. 268 Tax Code of the Russian Federation

<7>clause 2 art. 268 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated September 18, 2009 N 03-03-06/1/590

<8>clause 1 art. 346.15, paragraph 1 of Art. 346.17, paragraph 1 of Art. 346.18 Tax Code of the Russian Federation

<9>clause 1 art. 346.15, subd. 23 clause 1 art. 346.16, paragraph 1, sub. 2 p. 2 art. 346.17 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated October 29, 2010 N 03-11-09/95

<10>clause 1 art. 105.3 Tax Code of the Russian Federation

<11>clause 1 art. 105.17, paragraph 1 of Art. 105.14 Tax Code of the Russian Federation

<12>clause 4 art. 89 Tax Code of the Russian Federation

<13>subp. 1 item 2 art. 105.14 Tax Code of the Russian Federation

<14>clause 4 art. 105.3 Tax Code of the Russian Federation

<15>pp. 3, 6 tbsp. 105.3 Tax Code of the Russian Federation

<16>subp. 1 clause 1, clause 3 art. 105.7, paragraphs. 1, 7 tbsp. 105.9 Tax Code of the Russian Federation

<17>clause 5 art. 105.3, sub. 4 p. 2 tbsp. 45 Tax Code of the Russian Federation

<18>clause 1 art. 129.3 Tax Code of the Russian Federation; clause 9 art. 4 of the Law of July 18, 2011 N 227-FZ

<19>subp. 1, 4 p. 4 tbsp. 105.3, paragraph 2 of Art. 346.11 Tax Code of the Russian Federation

<20>clause 1 art. 105.3, paragraphs. 1, 2 tbsp. 105.18 Tax Code of the Russian Federation

<21>clause 1 art. 50 Civil Code of the Russian Federation

<22>Art. 252 Tax Code of the Russian Federation; Definitions of the Constitutional Court dated December 16, 2008 N 1072-O-O (clause 2 of the motivational part), dated June 4, 2007 N 366-O-P (clause 3 of the motivational part), dated June 4, 2007 N 320-O-P (clause . 3 motivational parts)

Many people are interested: will they have to pay taxes when selling a car, while circumventing tax requirements and avoiding additional expenses? The Russian tax system is considered quite soft compared to Western countries, however, a 13% income tax often causes a lot of indignation. Taxes on transport and on personal income are an important part of budgets at all levels, and evasion of them leads to very serious troubles.

Taxes on the sale and purchase of cars

The sale of cars is one of the types of income, information about which is provided to the tax authority at the place of registration. However car sales are not taxed in all cases, it is important to know a few important nuances. Let's look at the most common situations and frequently asked questions:

- I sold my car: will I have to pay income tax? This tax must be paid only if you have owned the car for less than three years. If 3 years have already passed, then the transaction will not be taxed, and there is no need to submit a declaration to the tax authority regarding it.

You will also not have to pay taxes if the cost of the car sold does not exceed 250,000 rubles. This is the minimum amount subject to tax, and if the car costs less, then the seller will not face additional tax costs.

- Will I have to pay tax if the car is sold for more than it was bought for? Yes, such a transaction is considered income, so it is necessarily taxed. However, you can pay a fee not for the entire amount, but only for the difference between income and expenses, that is, only for the amount of profit.

For example, a person bought a car for 350,000 rubles, and a year later found a buyer for it for 400,000 rubles. If both sales contracts and payment documents have been preserved, tax can only be paid on income, that is, on 50,000 rubles. 13% of this amount will be 6,500 rubles.

- If you bought a car, what tax will you have to pay? When completing a transaction, the buyer does not have to pay taxes, since he does not make a profit. In the future, since he became the owner of the car, the new owner must annually bear the tax burden for transport tax, depending on the engine power.

- Is there a tax deduction when buying a car? Russia is a social state that is obliged to help its citizens. Because of this, when making some large transactions, such as purchasing a plot of land, an apartment or a house, it is possible to receive a tax deduction. However, when buying a car, this option is not provided for by the tax code. The deduction is not given either when purchasing a new car or when choosing a car on the secondary market.

At the same time, car sellers can count on a tax deduction. It is 250,000 rubles, and if an expensive car was involved in the transaction, then an application for the deduction is submitted to the tax authority. 250,000 is deducted from the profit amount, and only the resulting balance will be taxed at 13%. This benefit will allow you to save significantly and make the sale of your car more profitable.

Is it worth trying to circumvent tax laws?

As long as taxes exist, there will always be people trying to find a loophole in the laws and avoid paying taxes, including when selling cars. This is especially true for resellers who have to part with part of their profits after each transaction. Because of this, the buyer and seller may be offered several dubious schemes that will relieve taxes, but can lead to larger troubles:

- Purchasing a car through a general power of attorney. Legally, such a transaction is not considered a sale at all, so formally the owner will remain the same. Since there is no sale, then there is no income tax, but few people think that the annual transport fee still needs to be paid. As a result, the previous owner is forced to pay tax until the new owner re-registers the car. He, naturally, is in no hurry to do this, and the matter can drag on for a very long time. However, a general power of attorney is also dangerous for the buyer, since it can be revoked at any time and the car can be returned.

- The buyer is offered to indicate in the contract a lesser amount than it actually is. It should not exceed 250,000 rubles, then the seller will not have to pay tax on income from the sale. The kind-hearted buyer agrees, gives the money, after which major defects are discovered in the car. The transaction is cancelled, but only the amount specified in the contract is returned to the buyer. It is simply impossible to prove that you actually paid more. Any fraud is based on excessive gullibility and the desire to save money and time.

Failure to pay taxes is initially subject to penalties. For individuals, the minimum fine is 1,000 rubles, but you will still have to pay tax. Willful defaulters may be fined large sums, possibly subject to arrest, and subsequently the initiation of criminal prosecution.

Tax amount calculation

What is the minimum tax amount when selling a car, and how exactly is it calculated? The amount of tax on the sale of a car depends on the transaction amount and the availability of a tax deduction. Calculation example:

Citizen A. sold a car worth 650,000 rubles; he owned it for only two years. The seller received a tax deduction in the amount of 250,000 rubles. Calculation:

650,000 – 250,000 = 400,000 rubles - this is the amount that will be taxed.

400,000 *13% = 52,000 rubles - this is how much you have to pay in the end. The tax return on additional income in form 3-NDFL is submitted no later than April 30 of the next calendar year after the purchase. The buyer will be required to pay transport tax by November of the following year.

Tax notices usually arrive by mail, but for some reason they may be delayed. You can check the existence of debt using the government services website, where you can also get additional information about various fees and payments.

Let's try to figure out what the size of the tax payment depends on, whether you need to pay it in your case and how this can be done.

The portal was advised on this matter by automobile lawyer and human rights activist Sergei Lyalikov.

Any citizen who receives some income must pay the state 13% of this amount. When it comes to wages, the employer is responsible for taxes. If you intend to sell property (and thereby receive income!), then you will have to interact with the Federal Tax Service (FTS) yourself.

However, all of the following does not apply to persons who owned the car for 3 or more years before it was sold. Income from the sale of such a car is not subject to taxation at all in accordance with clause 17.1 of Art. 217 of the Tax Code of the Russian Federation and there is no need to inform the tax authorities about the fact of sale of such property.

Please note: the period during which the car was owned by the taxpayer is calculated not from the moment it is registered with the State Traffic Safety Inspectorate, but from the moment the vehicle was acquired into ownership. Accordingly, the expiration date of this period is the day the transaction for the sale of the car to the new owner is concluded. In other words, if a person purchases your car at the end of December 2014, but registers it at the beginning of January 2015, the Federal Tax Service will consider that you received income in 2014.

What should you do if you have owned your car for less than three years?

Submit an income tax return to the Federal Tax Service and indicate there the amount received from the sale of the car. Even if for one reason or another you do not owe the state a single ruble. We will talk about the deadlines and methods for filing a declaration, as well as sanctions for failure to submit it below.

What will serve as confirmation of the length of ownership of the car and its value?

Such a document can serve as . Just in case, we recommend that you keep copies of all agreements on car transactions that you have ever entered into. It is necessary that the fact of transfer of money to the seller be documented. The evidence can be a check, a receipt receipt, a certificate confirming the deposit of money into an account, or, as a last resort, a receipt.

In what cases can you not pay sales tax?

If you have owned the car for more than three years, as mentioned above.

- If you can document that you are selling the car cheaper than you bought it, that is, the income you received from the sale of the car is not compensated by the expenses incurred earlier.

-If you sold the car for less than 250 thousand rubles.

The last point is worth dwelling on in more detail. 250 thousand rubles is the limit for property tax deduction, which is provided for by the modern version of the Tax Code. By this amount you can legally reduce the tax base (in this case, the amount received from the sale of the car). If you cannot document that you bought the car for more than you are selling, submit an application for a tax deduction along with your declaration (it is not automatically provided). Then the tax amount will be calculated using a simple formula: (Sale amount - 250,000) * 0.13. Accordingly, if you sell a car for less than 250 thousand, then the tax base will be zero.

What tax should I pay if I sell a car for more than it was purchased for?

In this case, you should be guided by the formula that we gave above: subtract the purchase amount from the sales amount and multiply the result by 0.13. That is, if you bought a car for 500 thousand rubles, and sell it for 600 thousand, then you will pay tax on 100 thousand. However, even if you derive some benefit, but sell the car for less than 250 thousand rubles, you still have the right to use tax deduction and pay nothing to the state.

How to file an income tax return?

You can submit it in three ways:

- Personally come to the district department of the Federal Tax Service and fill out the declaration form there.

- Send the completed declaration to the Federal Tax Service by a valuable letter with a list of the attachments.

- Send a declaration via the Federal Tax Service website r78.nalog.ru. In the corresponding section on personal income tax (NDFL), there is a link to download the required form with detailed instructions for filling it out, as well as a special computer assistant program “Declaration 2010”.

Until what date can I submit a declaration?

You must notify the Federal Tax Service about your income the next year after you sold the car. If you made a transaction in 2014, then in 2015 you had to submit a declaration by May 3, 2015. Information about deadlines varies from year to year, and usually the “deadline” for the next year is announced at the end of the previous year. So if you are selling your “iron horse” now, do not forget to look at r78.nalog.ru in December 2014.

What happens if you don't file a declaration?

According to Article 119 of the Tax Code, failure to submit a declaration within the prescribed period is punishable by a fine of 5% of the tax amount for each full month from the deadline for filing the declaration, but not more than 30% of this amount and not more than 1000 rubles. And since you did not inform the Federal Tax Service how much you sold the car for, you will most likely face a minimum fine of 1,000 rubles.

If the purchase and sale agreement for a car is lost, is it possible to get it from the MREO where the car was registered?

The legislation provides such an opportunity: according to clause 38 of Order of the Ministry of Internal Affairs No. 1001, which regulates the rules for registering vehicles, MREO employees are obliged to return to you the original purchase and sale agreement of the car in their possession if you submit a corresponding written application.

Will I be charged tax if I sell a car by proxy?

The “sale” of a car by power of attorney is not a purchase and sale transaction under the law, since the nominal owner does not change. If you are selling a car by proxy three years after purchase, or you know for sure that the buyer will not resell it under the contract until the expiration of this three-year ownership period, you do not have to worry about filing a declaration.

It's another matter if you owned the car for less than three years and then sold it at the "general" price. Ask the buyer to notify you in a timely manner if he decides to officially register it in his name or resell it under a contract. Then you will be able to know exactly when you need to submit a declaration and avoid sanctions from the Federal Tax Service. You should not sell a car by proxy if you do not know the buyer well and do not have the opportunity to quickly contact him.

Currently, many organizations are forced to sell goods at a price lower than the purchase price. Some accountants doubt the legality of such actions. Read about the tax consequences of such transactions in the material prepared by specialists of the 1C:Consulting.Standard project.

The basis for writing the material was a question received at the consultation line of the project "1C: Consulting. Standard":

Russian legislation does not contain a prohibition on selling goods at a price lower than the purchase price. Therefore, of course, you can sell this product for 600,000 rubles.

But in this case, you should keep in mind the possibility of adverse tax consequences.

Charge of lack of a reasonable business purpose.

Referring to the unprofitability of the transaction, the inspectors say about the absence in the actions of the taxpayer reasonable business purpose and about their receipt unjustified tax benefit in the form of illegal VAT refund from the budget. At the same time they try challenge the right to deduct input tax for this product. And in this case, judges support controllers quite often.

For example, the FAS of the East Siberian District, in resolution dated January 17, 2007 No. A33-5877/05-F02-7258/06-S1 in case No. A33-5877/05, supported the tax authorities, indicating that the transactions performed by the taxpayer were not economically feasible, because the purchase price of the goods was higher than the selling price for export.

In the decision of the Federal Antimonopoly Service of the Volga Region dated March 29, 2006 in case No. A12-27621/05-C21, the judges came to the conclusion that there was no reasonable business purpose, since the transactions were obviously unprofitable for the taxpayer.

And the Federal Antimonopoly Service of the West Siberian District refused to deduct VAT from the taxpayer, since the purchase price of the goods was inflated seven times, and the subsequent the sale price did not cover all the taxpayer's costs. The court also noted that such business transactions are not carried out unless otherwise hidden behind them(resolution dated August 10, 2005 in case No. F04-5166/2005(13823-A46-18)).

Fortunately, there are also plenty of examples of court decisions in favor of taxpayers in arbitration practice. For example, in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 20, 2006 No. 3946/06 in case No. A40-19572/04-14-138, the arbitrators concluded that the fact of sale of goods for export at a price that is lower than the purchase price goods from a Russian supplier, in itself, without connection with other circumstances of a particular case, cannot indicate bad faith of the company and be considered as an objective sign of bad faith.

Similar conclusions can be found in the decisions of the FAS Moscow District dated March 11, 2008 No. KA-A40/1209-08 in case No. A40-35330/07-99-146, the FAS Volga District dated January 15, 2008 in case No. A65-1289/07- SA3-48, FAS of the Ural District dated June 13, 2007 No. F09-4305/07-C2 in case No. A07-28178/06, FAS of the Central District dated February 19, 2008 in case No. A35-1831/07-C18.

In the Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 28, 2006 No. 13234/05 in case No. A40-245/05-117-4 and dated February 28, 2006 No. 12669/05 in case No. A40-3898/05-118-48 it is stated that the fact Selling a product at a price lower than the purchase price does not indicate the absence of a reasonable business purpose.

And the Federal Antimonopoly Service of the Ural District, in its resolution dated February 11, 2008 No. F09-208/08-S2 in case No. A71-4398/07, stated that on its own the fact that there is no profit does not indicate bad faith on the part of the taxpayer, as well as the lack of real economic effect from relationships with these suppliers.

The judges also point out that the right to apply tax deductions is not dependent on profit, which the taxpayer received. In accordance with Art. 2 of the Civil Code of the Russian Federation, entrepreneurial activity is independent and is carried out at its own risk, that is, as a result, the organization’s activities may turn out to be both profitable and unprofitable (resolution of the Federal Antimonopoly Service of the Moscow District dated January 21, 2008 No. KA-A40/12666-07 in case No. A40-67664 /06-75-390).

Similar conclusions are contained in the resolution of the Federal Antimonopoly Service of the Moscow District dated August 14, 2008 No. KA-A40/6296-08 in case No. A40-59005/07-129-351. The court rejected the inspector’s argument that the taxpayer’s activities were unprofitable, pointing out that this fact is not a basis for refusing a VAT refund, since Current legislation does not link the right to apply a deduction with the presence of profit or loss, that is, with the profitability of transactions.

Another example from arbitration practice. In our opinion, it may be useful in the situation under consideration. This is the resolution of the Federal Antimonopoly Service of the Central District dated 06/04/2008 in case No. A54-2364/2007С21. In making its decision, the court rejected the tax authority’s argument that the transaction was unprofitable and indicated that the taxpayer sold the goods at a price lower than the purchase price due to a decrease in its quality. Of course, when using this argument, the taxpayer must be prepared to confirm the fact of a decrease in the quality of the goods.

Tax authorities control prices to ensure their compliance with market prices.

According to paragraph 1 of Article 40 of the Tax Code of the Russian Federation, for tax purposes, the price of goods, work or services indicated by the parties to the transaction is accepted. Until proven otherwise, it is assumed that this price corresponds to the level of market prices.

Tax authorities have the right to check the correctness of application of prices for transactions only in the following cases (clause 2 of Article 40 of the Tax Code of the Russian Federation):

- between interdependent persons;

- on commodity exchange (barter) transactions;

- when making foreign trade transactions;

- if there is a deviation of more than 20% upward or downward from the level of prices used by the taxpayer for identical (homogeneous) goods (works, services) within a short period of time.

If the price of a product differs from the market price by more than 20%, the tax authorities have the right to check the correctness of the application of prices and make a reasoned decision on additional tax and penalties, calculated in such a way as if the results of this transaction were assessed based on the application of market prices for the corresponding goods (clauses 2 and 3 of Article 40 of the Tax Code of the Russian Federation).

At the same time, Art. 40 of the Tax Code of the Russian Federation contains the principles for determining market prices. Note that according to paragraph 3 of Article 40 of the Tax Code of the Russian Federation, when determining the market price discounts may be taken into account caused by:

- seasonal and other fluctuations in consumer demand for goods (works, services);

- loss of quality or other consumer properties of goods;

- expiration (approximation of the expiration date) of the shelf life or sale of goods;

- marketing policy, including when promoting new products that have no analogues to markets, as well as when promoting goods (works, services) to new markets;

- implementation of experimental models and samples of goods in order to familiarize consumers with them.

In this case, if, taking into account the provisions of Article 40 of the Tax Code of the Russian Federation, the tax authorities come to a reasonable conclusion that the price of the goods applied by the taxpayer deviates from the market price by more than 20%, they have the right to assess additional taxes based on market prices. In this case, both VAT and income tax will be additionally charged, as well as corresponding penalties for these taxes.

Note! When applying Article 40 of the Tax Code of the Russian Federation, the disputed price must be compared specifically with market prices for identical (similar) goods. Comparison with the purchase price of goods (with the cost of products, works, services) is not allowed. This has been brought to the attention of the Supreme Arbitration Court of the Russian Federation more than once. Thus, in the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 17, 2003 No. 71 (clause 4), the judges indicated the invalidity of the tax authority’s decision to assess additional taxes under Article 40 of the Tax Code of the Russian Federation for the reason that the tax authority did not examine the issue of the level of deviation during the audit transaction prices from market prices. Wherein market prices were not set at all, and for the purpose of recalculating income tax the cost of services indicator was used(services were sold at prices below cost).

Not long ago, the highest judicial body confirmed its point of view regarding this issue (see Determination of the Supreme Arbitration Court of the Russian Federation dated May 6, 2008 No. 5849/08). In making the decision to assess additional value added tax, penalties and fines to the company, the inspectorate proceeded from the fact that, By selling goods below the purchase price, the company operates at a loss. The judges did not take into account the tax authority’s argument about lowering prices below cost, since the issue of establishing the market price of goods was not investigated by the inspectorate.

Similar articles